15g Form For Pf Withdrawal Rules

Employees Provident Fund Organization has issued a new circular relating to applicability of TDS (Income Tax deduction at Source) on EPF withdrawals. These new provisions are effective from 1st June, 2015. TDS is applicable on EPF withdrawal where accumulation (balance) is more than Rs 30,000 and the EPF member (Employee) has worked less than Five years. As per EPFO’s circular, “the Finance Act, 2015 (20 of 2015) has inserted a new section ‘192A’ regarding the payment of accumulated provident fund balance due to an employee.

The provision shall take effect from June 1, 2015.” EPF Withdrawals – Provisions related to TDS TDS is not applicable in the following cases; • On Transfer of PF from one account to another PF account (EPF A/c). • On Termination of service due to ill-health of EPF member and withdraws his/her accumulation. • On discontinuation of Business by the Employer or any cause beyond the control of EPF Scheme’s member (Employee). • If PF withdrawal amount is less than Rs 30,000. • If employee withdraws amount more than or equal to Rs.

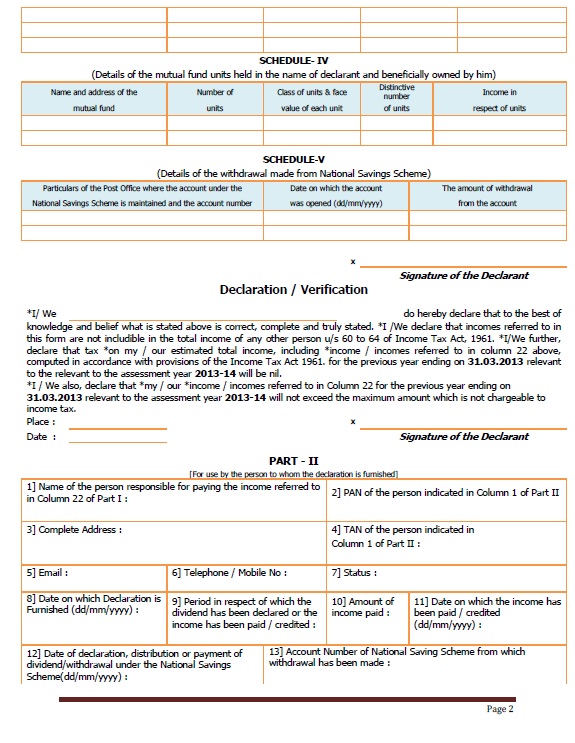

30,000/-, with service less than 5 years but submits Form 15G /15H along with his / her PAN. TDS is applicable in the following scenarios; • If employee withdraws amount more than or equal to Rs. 30000/-, with service less than 5 years, then: • a) TDS will be deducted @ 10% if Form-15G/15H is not submitted provided PAN is submitted. B) TDS will be deducted @ maximum marginal rate (i. Driver Epson M105. e., 34.608%) if employee fails to submit PAN Other Important points; • TDS (Tax Deducted at Source) is deductible at the time of payment.

Comments are closed.